Nigeria’s Central Bank has slammed the brakes on further rate hikes. For the fourth straight meeting, the Monetary Policy Committee kept the benchmark rate unchanged at 27%, giving the economy breathing room after one of the most aggressive tightening cycles in years.

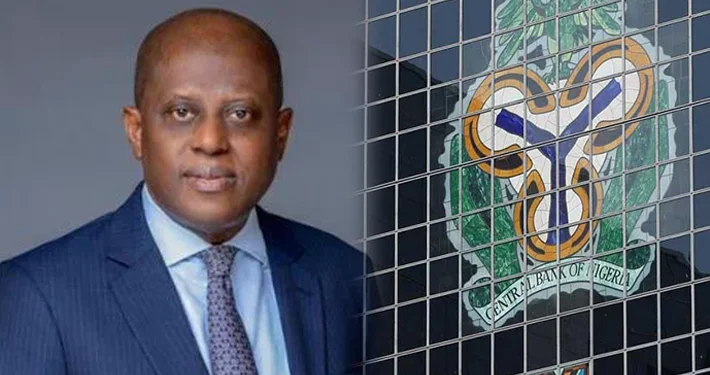

Governor Olayemi Cardoso told reporters Tuesday that the 12-member committee wants previous increases to fully work through the system before making another move.

Key Decisions

- Benchmark rate: unchanged at 27%

- Asymmetric corridor: +50 / -450 basis points

- Cash Reserve Ratio: unchanged (45% commercial banks, 16% merchant banks)

- Liquidity ratio: steady at 30%

Inflation Finally Cooling

The gamble appears to be paying off. Headline inflation has now fallen for seven straight months — from 34% a year ago to 16.05% in October. Food inflation dropped to 13.12%, while core inflation eased to 18.69%.

Cardoso credited tighter policy, a calmer forex market, rising capital inflows, and stable fuel prices.

External Reserves Hit $46.7 Billion

A standout highlight: Nigeria’s foreign reserves jumped to $46.7 billion — enough to cover 10 months of imports and the strongest buffer in years.

“Investors who fled volatility are coming back,” Cardoso said. “Stability brings investment. Investment brings jobs and growth. Nigerians will feel it soon.”

FX Market “Most Transparent Ever”

Daily turnover now averages $500 million without heavy CBN intervention. Cardoso boasted that travellers can use naira cards abroad without panic, and the electronic platform lets everyone see who is buying and selling a far cry from the old opaque system.

Growth Picking Up

- Q2 GDP: 4.23% (up from 3.13% in Q1)

- November PMI: 56.4 — highest in five years

- 16 banks already recapitalised; 27 more raising capital

End of the Trillion-Naira Intervention Era

Cardoso confirmed the bank has recovered about ₦2 trillion from past intervention loans totalling ₦10.93 trillion. Outstanding debts, he said, are tying the CBN’s hands on new programmes. “The old model distorted markets and created moral hazard. We’re done with that,” he declared.

Grey List Exit Celebrated

Nigeria’s removal from the FATF grey list was hailed as a game-changer for remittances, correspondent banking, and global investor confidence.

For the first time in years, the message from the Central Bank is clear: The fire is under control. Now it’s time to rebuild.