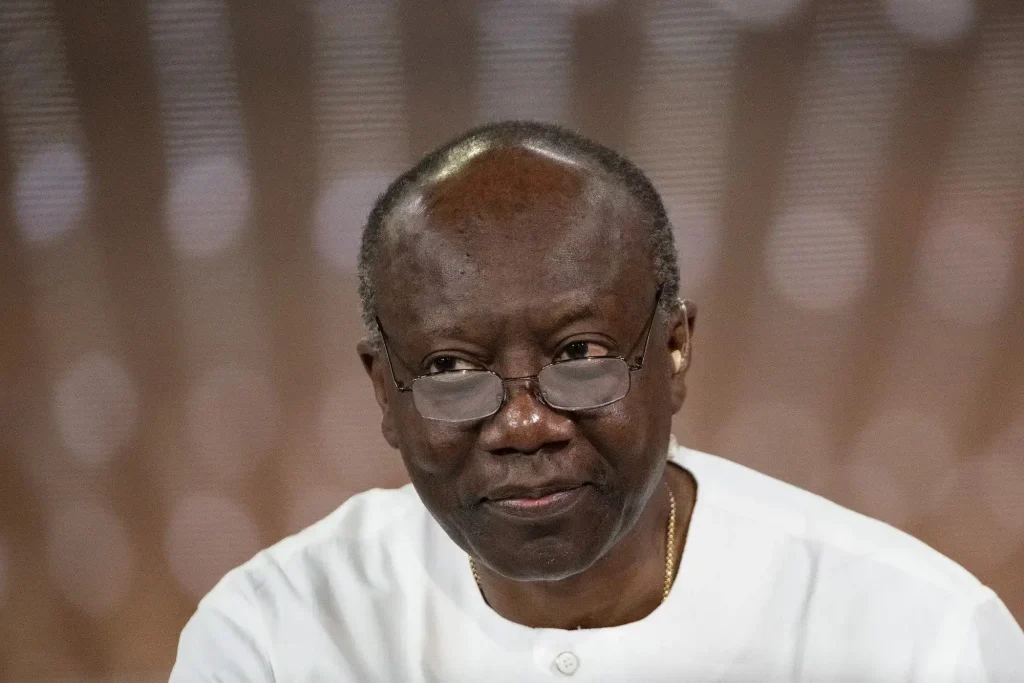

Ghana’s Finance Minister, Ken Ofori-Atta, is set to convene with representatives from the Individual Bondholders’ Forum on January 18, 2023, to address their petition for exclusion from the Domestic Debt Exchange Programme (DDEP). This meeting comes amid growing concerns over the program’s impact on individual investors, following the government’s extension of the signup deadline to January 31, 2023. The forum, comprising holders of various government bonds, has voiced strong opposition, highlighting the program’s potential to devastate personal finances without prior consultation.

Details of the Scheduled Meeting

The invitation from Ofori-Atta aims to discuss the forum’s formal petition, submitted after the DDEP’s announcement. As shared by Imani Africa President Franklin Cudjoe on social media, the dialogue focuses on the group’s demand for exemption, emphasizing the need for stakeholder engagement. The extension of the deadline from January 16 to January 31 reflects the government’s effort to build consensus, as stated in a Ministry of Finance release: “Building consensus is key to a successful economic recovery for Ghana.” This marks a critical step in addressing the unrest caused by the program, which has faced widespread criticism since its launch in December 2022.

Reasons Behind the Petition

The Individual Bondholders’ Forum, representing investors in Government of Ghana Local Cedi Bonds, Local USD Bonds, ESLA PLC Bonds, Daakye Bonds, Ghana Eurobonds, and Collective Investment Schemes, argues that the DDEP is one of the harshest debt restructuring measures ever proposed. Members describe the announcement as unsettling and catastrophic, fearing impoverishment due to the program’s terms. Key grievances include the lack of consultation and the perceived inequity, as the restructuring could erode savings without adequate safeguards for individuals.

The forum’s rejection stems from the program’s structure, which exchanges existing bonds for new ones maturing in 2027, 2029, 2032, and 2037, with a zero percent coupon in 2023, five percent in 2024, and ten percent from 2025. “This is unacceptable,” forum conveners have stated, hinting at potential nationwide demonstrations if their demands are ignored. Their stance underscores broader public discontent, as the DDEP affects a wide range of Ghanaians reliant on bond investments for financial security.

Overview of the Domestic Debt Exchange Programme

Launched to manage Ghana’s GH¢137 billion in domestic debt, the DDEP invites bondholders to voluntarily exchange notes and bonds, including ESLA and Daakye, for new instruments. The initiative aims to alleviate fiscal pressures amid economic challenges, but it has met resistance from the business community and citizens. Critics argue it prioritizes government relief over investor protection, leading to calls for exemptions and revisions.

The program’s extension allows for further dialogue with institutional and individual investors, acknowledging the need for inclusive recovery strategies. However, the forum’s petition highlights the human cost, as many members face financial hardship without exemptions.

Potential Implications and Next Steps

The January 18 meeting could shape the DDEP’s future, potentially leading to adjustments for individual bondholders. If unresolved, it risks escalating tensions, with protests looming. Ghana’s economic context, including currency depreciation and inflation, amplifies the stakes, as the program is part of broader efforts to stabilize finances.

As discussions unfold, stakeholders watch closely, hoping for equitable solutions that balance national needs with individual rights. The outcome may influence public trust in government policies during this critical period.