Nigeria emerged from recession in Q4 2020, following two consecutive quarters of negative GDP growth. However, in 2021, the economy continued to struggle under mounting inflation, surging unemployment, a rising debt burden, and dwindling investor confidence—failing to return to its pre-pandemic strength.

Despite a faster-than-expected recovery with 0.11% GDP growth in Q4 2020, 2021 proved a difficult year for Africa’s largest economy. Nairametrics takes a closer look at the key economic indicators that highlight the nation’s continued fiscal and structural challenges.

Persistent Exchange Rate Instability

The naira weakened by 6.03% at the official exchange rate in 2021, ending the year at ₦435/$1, compared to an average of ₦410.3/$1. On December 30, the naira depreciated by 4.82%, a pattern reminiscent of 2020’s 4.12% year-end drop.

At the parallel market, the naira closed at ₦565/$1—down 22.8% against the dollar—widening the gap between official and black market rates from ₦49.75 in 2020 to ₦140.74 in 2021.

Despite over $32 billion traded at the Investors & Exporters (I&E) window, sustained pressure from a negative trade balance, reduced remittances, lower capital inflows, and weak crude exports continues to burden the exchange rate.

Government Revenue Shortfalls

Nigeria’s longstanding challenge with revenue generation continued in 2021. As of May, retained revenue stood at ₦1.84 trillion—33.3% below the projected ₦2.77 trillion.

Oil revenue performed particularly poorly, achieving just 50.5% of the expected ₦837.9 billion. Meanwhile, non-oil revenue fared better, with Company Income Tax (CIT) and VAT surpassing targets by 2.4% and 24.7%, respectively.

Nigeria’s inability to meet OPEC+ production quotas, compounded by rising subsidy costs, signals ongoing pressure on oil revenues.

Record-High Unemployment Rate

In Q4 2020, the unemployment rate hit a historic high of 33.3%, with over 23 million Nigerians jobless. The labour force shrank by over 10 million, while full-time employment dropped by 14%, from 35.6 million in Q2 to 30.6 million by year-end.

The lingering effects of the COVID-19 lockdown—including layoffs and salary cuts—continued to impact labour market recovery throughout 2021.

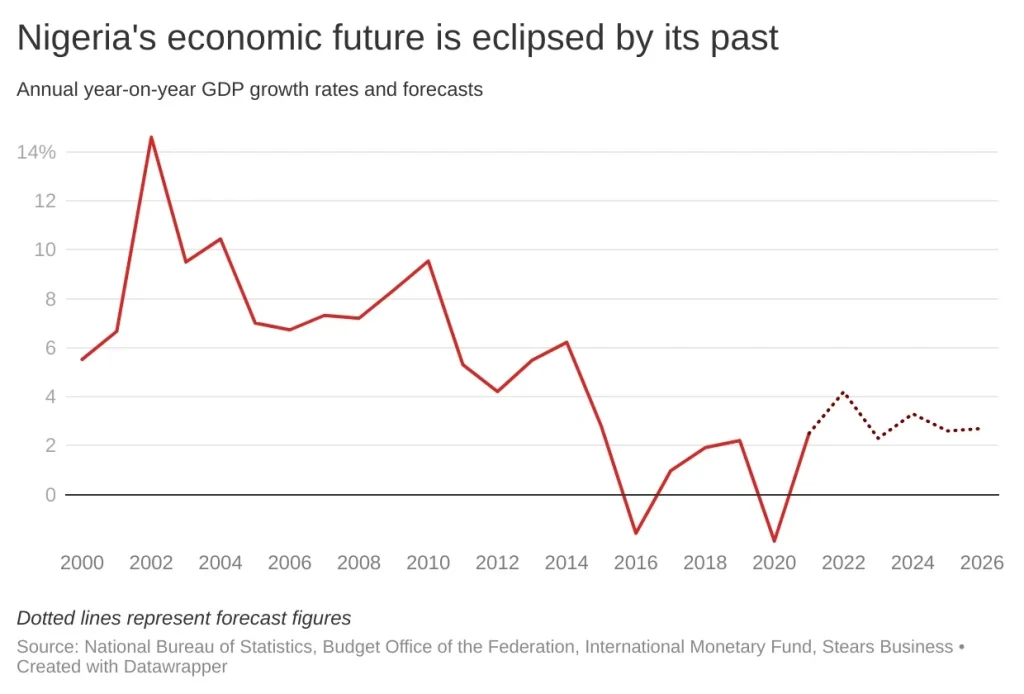

GDP Growth Masked by Base Effects

Nigeria recorded GDP growth of 0.51% in Q1, 5.01% in Q2, and 4.03% in Q3 2021. These figures suggest economic recovery but were largely driven by base-year comparisons from the sharp contractions of 2020.

The non-oil sector was a key contributor, with notable performances in telecommunications and trade.

Soaring Inflation

Inflation remained a major concern. In March 2021, the headline inflation rate climbed to 18.17%—its highest since January 2017. Food inflation peaked at 22.95%, while core inflation stood at 12.74%.

The inflation surge was attributed to rising transportation costs, health service expenses, and ongoing disruptions in food supply chains, despite government intervention in agriculture.

By November 2021, headline inflation eased to 15.4%, mainly due to base effects rather than structural improvements.

Nigeria’s Growing Debt Burden

Public debt soared to ₦38 trillion in Q3 2021, up from ₦35.47 trillion in Q2. External debt increased to $37.96 billion, fueled by a $4 billion Eurobond secured in September, while domestic debt rose to $54.67 billion.

Between January and September 2021, Nigeria spent ₦1.74 trillion and $1.82 billion on domestic and external debt servicing, respectively—posing serious concerns for fiscal sustainability.

Widening Trade Deficit

From Q4 2019 to Q3 2021, Nigeria recorded persistent trade deficits. In Q3 2021 alone, imports rose by 51.1% year-on-year to ₦8.15 trillion, the highest ever recorded.

Exports failed to match this growth, largely due to underperformance in crude oil output—Nigeria’s primary export commodity. The widening deficit further impacted the balance of payments and intensified exchange rate pressures.

Borrowed Reserves Growth

Nigeria’s foreign reserves increased by $5.15 billion in 2021 to $40.52 billion, bolstered by the $4 billion Eurobond and $3.35 billion IMF SDR allocation.

However, reserves began to decline after peaking at $41.8 billion in October, losing $1.3 billion in just two months. This rise in reserves, primarily through borrowing, raises concerns about future debt obligations.

Weak Foreign Investment Inflows

Foreign investment remained low throughout 2021. Portfolio inflows stood at $551 million, while direct investments were a meager $77.97 million—far below pre-pandemic levels.

The government hopes that reforms such as the Petroleum Industry Act (PIA) and global recovery from COVID-19 will boost investment in 2022.

Stock Market Disappoints

The Nigerian Exchange (NGX) returned just 6.07% in 2021, a sharp decline from the 50% gain recorded in 2020. This performance failed to outpace the country’s inflation rate, reducing the real value of investor returns.

A bearish first half was partially corrected by a bullish second half, but the market remained unattractive to foreign investors—limiting its impact on broader liquidity.

COVID-19: A Lingering Threat

COVID-19 continued to disrupt economic activities, with 154,774 new cases recorded in 2021—nearly double the number in 2020. The death toll also doubled to 3,031, and over 25,000 people were actively being treated by year-end.

Bottom Line

Despite signs of growth, 2021 was marred by structural weaknesses and economic instability. The Central Bank maintained rates to support recovery and restricted dollar sales to Bureau de Change operators. Meanwhile, the government expanded spending through a larger 2021 budget.

However, without improvements in productivity, export capacity, and investment inflow, Nigeria’s macroeconomic fundamentals remain fragile. All eyes are now on how the policies of 2021 will shape performance in the years ahead.