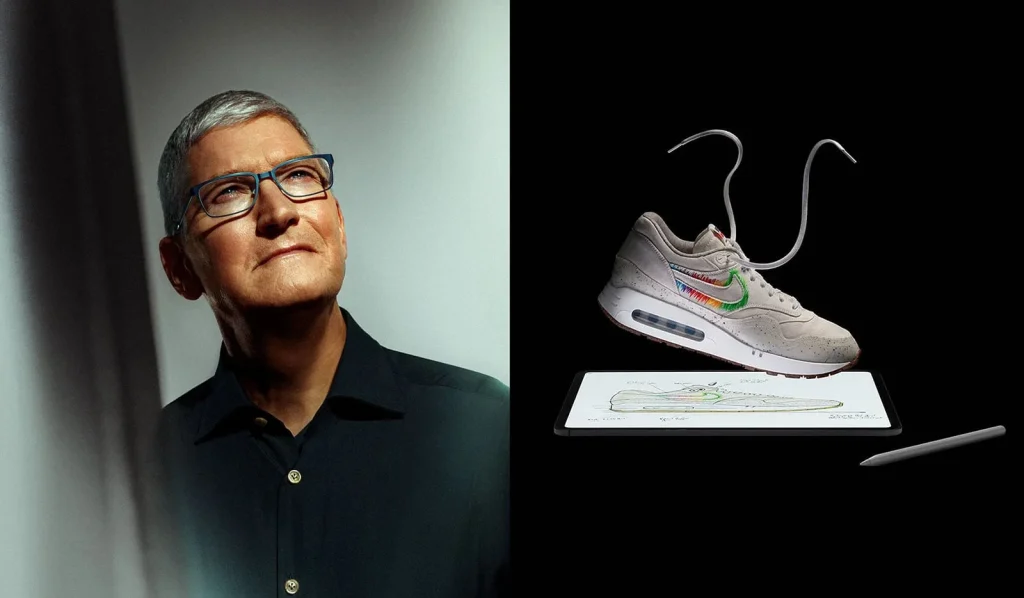

Apple CEO Tim Cook has executed a massive vote of confidence in Nike Inc., purchasing nearly $3 million worth of shares on the open market.

The move comes at a critical moment for the sportswear giant. Tim Cook Nike stock holdings have effectively doubled overnight, signaling a strong belief that the company is undervalued despite recent stumbling blocks.

Investors reacted positively to the news. Nike shares climbed 2% in premarket trading on Wednesday, December 24, 2025, halting a steep decline that began last week.

A Rare Open Market Purchase

According to regulatory filings released late Tuesday, Cook acquired 50,000 shares at an average price of $58.97.

This transaction serves as a significant milestone. Although Cook has sat on Nike’s Board of Directors since 2005—currently serving as Lead Independent Director—this is his first purchase of the company’s stock on the open market.

He now holds a total of 105,480 shares.

Stabilizing a Volatile Week

The timing of this investment is deliberate. It arrives just days after Nike’s stock value evaporated by nearly 13% following a disappointing quarterly earnings report on December 18.

Cook’s injection of capital counters the bearish sentiment surrounding the brand’s recent performance metrics:

-

China Revenues: Sales in Greater China have plummeted by 17% due to weak consumer demand.

-

Profit Margins: Gross margins tightened by 300 basis points, squeezed by tariffs and inventory bloat.

-

Yearly Lows: The stock remains down approximately 25% year-to-date.

By buying the dip, Cook is betting against the current market pessimism.

Broader Insider Optimism

Cook isn’t the only board member capitalizing on the lower share price.

Robert Swan, former Intel CEO and current Chair of Nike’s Audit Committee, also stepped in to buy 8,691 shares. His investment, valued at roughly $500,000, occurred on the same day.

These coordinated moves suggest that the board sees the current valuation as a buying opportunity rather than a distress signal. Both leaders appear aligned with CEO Elliott Hill’s emerging “Win Now” strategy, which aims to reboot product innovation and repair wholesale relationships to reverse the annual downtrend.

_____________________________________________________________________________________________________________________________