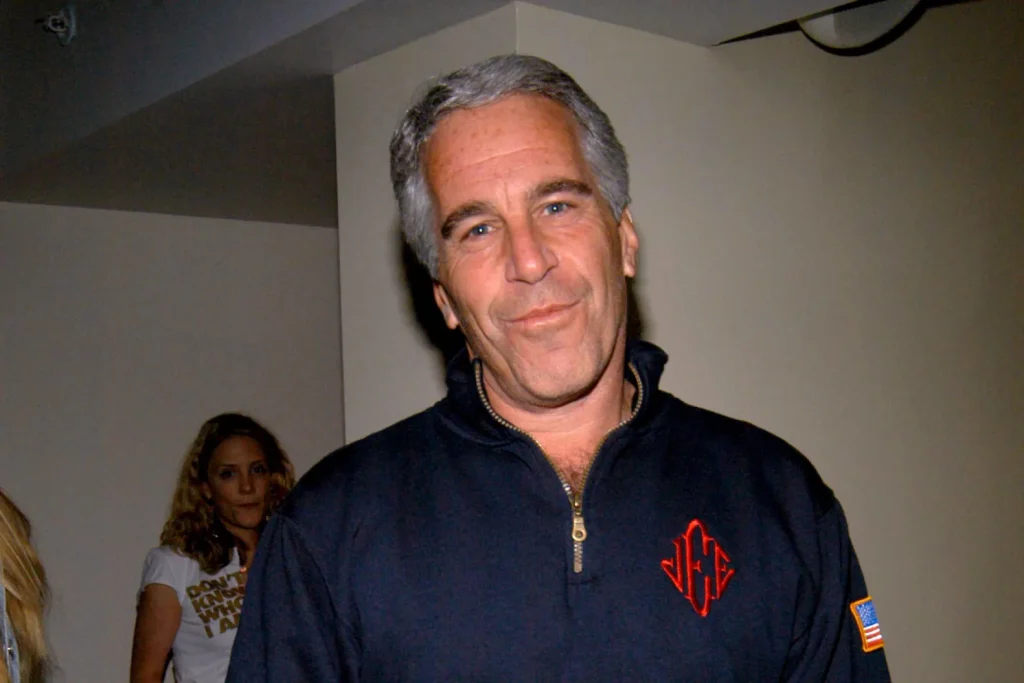

A woman who endured abuse from the late financier Jeffrey Epstein has filed a lawsuit against Bank of America, alleging the bank knowingly facilitated his sex trafficking activities through its financial services.

The legal action, launched on Wednesday, October 15, 2025, seeks to hold the institution accountable for its role over several years.

The plaintiff, identified as Jane Doe to protect her privacy, is pursuing unspecified damages for the harm suffered.

Lawsuit Targets Bank’s Role

The complaint claims Bank of America provided critical financial support that enabled Epstein’s illicit operations.

By handling his accounts, the bank allegedly allowed transactions that sustained his trafficking network, despite warning signs.

Jane Doe’s legal team argues the institution failed to act on suspicious activities, prioritizing profits over ethical oversight.

Bank of America has not issued a public response to the allegations. The case, filed in a New York federal court, adds to scrutiny of major banks linked to Epstein’s activities, highlighting systemic issues in financial oversight.

Legal Team with Proven Record

Jane Doe is represented by law firms Boies Schiller and Edwards Henderson, known for their work on similar cases.

These firms previously secured substantial settlements from other major banks accused of enabling Epstein’s crimes.

Their success includes a $75 million agreement with one bank and a $290 million deal with another, signaling their expertise in holding financial giants accountable.

The attorneys aim to prove Bank of America ignored red flags, such as large cash withdrawals or unusual transfers, which allegedly supported Epstein’s exploitation of victims. The lawsuit emphasizes the need for banks to strengthen anti-trafficking measures.

Broader Implications for Accountability

This case follows a pattern of legal actions targeting institutions tied to Epstein, who died in 2019 while facing federal sex-trafficking charges.

His high-profile status and wealth enabled a decades-long operation, drawing attention to how financial systems may inadvertently aid such crimes.

The lawsuit underscores the responsibility of banks to monitor client activities and report suspicious behavior.

Jane Doe’s action seeks not only compensation but also broader reform in how banks handle high-risk clients. It raises questions about due diligence and compliance with anti-money laundering laws, urging stricter protocols to prevent future abuses.

Impact on Victims and Industry

For survivors, the lawsuit represents a step toward justice and closure. It highlights the courage of those coming forward to confront powerful institutions.

The case could inspire more victims to seek accountability, amplifying calls for systemic change in banking practices.

As the lawsuit progresses, it may pressure Bank of America to review its internal policies. Other financial institutions could face similar scrutiny, prompting industry-wide changes to prioritize victim protection and ethical governance.

The case is a reminder of the long-lasting impact of Epstein’s actions. It challenges banks to act as gatekeepers against illicit activities, ensuring their services don’t enable harm.

As Jane Doe’s legal battle unfolds, it could reshape how financial institutions approach accountability and trust.