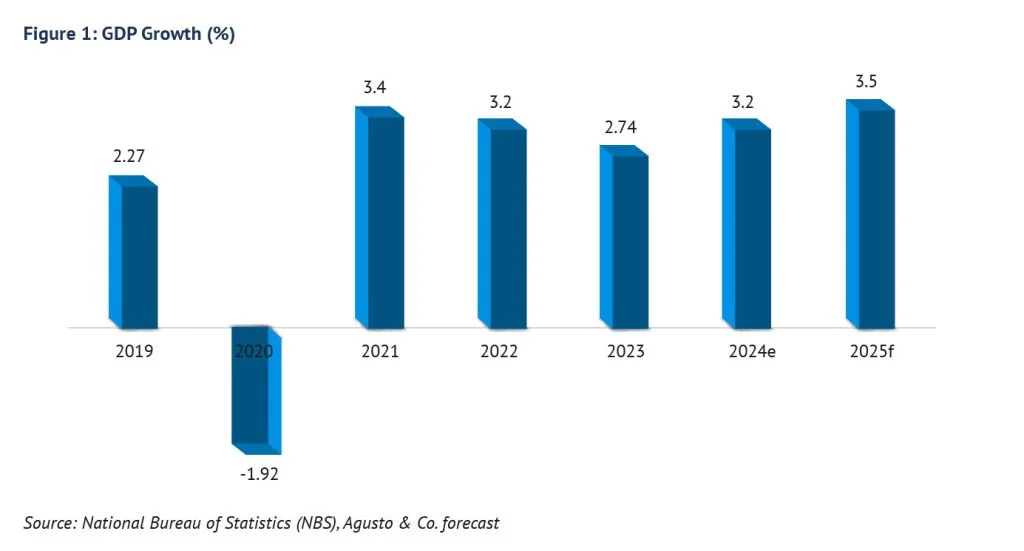

Wale Olusi, Head of Research at United Capital Plc, projects Nigeria’s GDP growth to exceed 2.3% in 2020, surpassing 2019’s 2.27% but remaining below 3.0%.

Recent policy changes, including the amended Deep Offshore and Inland Basin Production Sharing Contract Act and ongoing Tax Act reviews via the finance bill, will support the 2020 budget despite a rising debt profile.

The Central Bank of Nigeria’s (CBN) low-yield policies are expected to ease government borrowing costs and stimulate private sector investment.

Inflation and Monetary Policy

Inflation is forecasted to average 11.9% in 2020, up from 11.4% in 2019, driven by supply shortages from border closures and increased money supply pressuring foreign exchange (FX).

The Monetary Policy Rate (MPR) may remain at 13.5% or see a slight cut, with the CBN continuing its heterodox policy mix. Fixed income yields are expected to stay low in H1-2020, with Treasury bills at mid-to-high single digits and bonds at low double digits.

Exchange Rate Stability

Olusi predicts the CBN will maintain the naira at N360–N365/$1, using Open Market Operation (OMO) bill sales to foreign portfolio investors (FPIs) to preserve reserves above $30 billion for 7–9 months.

While devaluation concerns persist, Olusi foresees a harmonization of the official rate (N305.5/$1) with the Investors & Exporters (I&E) window rate (N360/$1), causing a 2–5% market rate adjustment in the medium term.

Fixed Income and Equities Outlook

The fixed income market will favor corporate issuers in H1-2020 due to high liquidity and low yields, with OMO bill rates stable to attract FPIs.

The equities market, down 14.6% in 2019, may see a modest 5.3% return in 2020, driven by local demand for dividend-paying stocks, though FPI interest remains low amid devaluation fears and preference for low-risk OMO bills.